The Multi-Market Challenge of Payments in Europe

Building a winning multi-market business in Europe demands localization; this applies to payments too. For a business to be competitive when entering a market, it must access local payment schemes, use local IBANs, or adhere to requirements from underwriters and partners. As such, it is essential to have internal financial infrastructure in place that is both scalable and cost-effective, helping you roll out new markets quickly. However, the fragmentation of European payments makes this a challenging task for companies to tackle.

Europe is still a fragmented payments ecosystem

Despite the Single Euro Payments Area (SEPA) harmonization efforts, the European payments landscape remains divided. There are more than 25 payment schemes and 13 different currencies within SEPA as it stands today. Sweden alone supports three types of credit transfers and a direct debit scheme for payments in SEK, not to mention the variety of schemes used in other European countries.

Why companies need multiple banking partners

Because of the fragmented ecosystem, businesses operating across multiple European markets need to partner with local banks to access domestic payment schemes and currencies, allowing them to take advantage of the cost savings and speed of settling transactions over local rails. This requires companies to establish local entities and build custom integrations with multiple banking partners, even legacy clearing systems in certain jurisdictions, e.g. Bankgiro in Sweden or Mastercard’s payment services in Denmark and Norway.

Pressure to open local bank accounts also comes from end customers. In most markets in the Eurozone and beyond, consumers and businesses prefer to transact with counterparties with locally issued accounts, meaning accounts with local International Bank Account Numbers (IBANs) or a domestic equivalent. Not localizing your banking partnerships can lead to churn and lower conversion rates. This is why many established companies have numerous banking partners and tend to move away from using Payment Service Providers (PSPs). With a PSP in the payment flow, customers have to pay into the PSP's account, which can create a disconnect and reduce trust with the customer base.

In industries such as lending and insurance, partners have specific requirements about which banks a company needs to leverage in a given market. While scaling a company across Europe, having to integrate with a local bank in each country significantly slows down the go-to-market motion and drains engineering resources. Alternatively, adopting manual processes to upload, monitor, and reconcile transactions in each bank’s online portal is extremely costly, error-prone, and doesn’t scale.

Managing multiple banking partners

To have a robust, cost-effective, and scalable financial infrastructure in place, it’s necessary to build a platform that can manage multiple banks, schemes, and currencies in a secure way. Next, approval chains, to ensure the four-eyes principle is followed, and audit trails, for reporting & troubleshooting, have to be layered on top, guaranteeing secure financial operations. The platform must be able to manage end-to-end payment flows and handle any unexpected issues, such as refunds & returns with live notifications in place. Lastly, integrations with banks and clearing houses need to be built to access local IBANs and payment rails. Keep in mind, integrating with a single bank can be a lengthy process with lead times of up to six months. The integration must often be done using legacy protocols such as SFTP, EBICS, or SOAP APIs, and each bank has its unique requirements. The same holds for managing multiple local schemes for credit transfers and direct debits just through a single bank, as each scheme has its characteristics, which require custom logic.

How Atlar can help

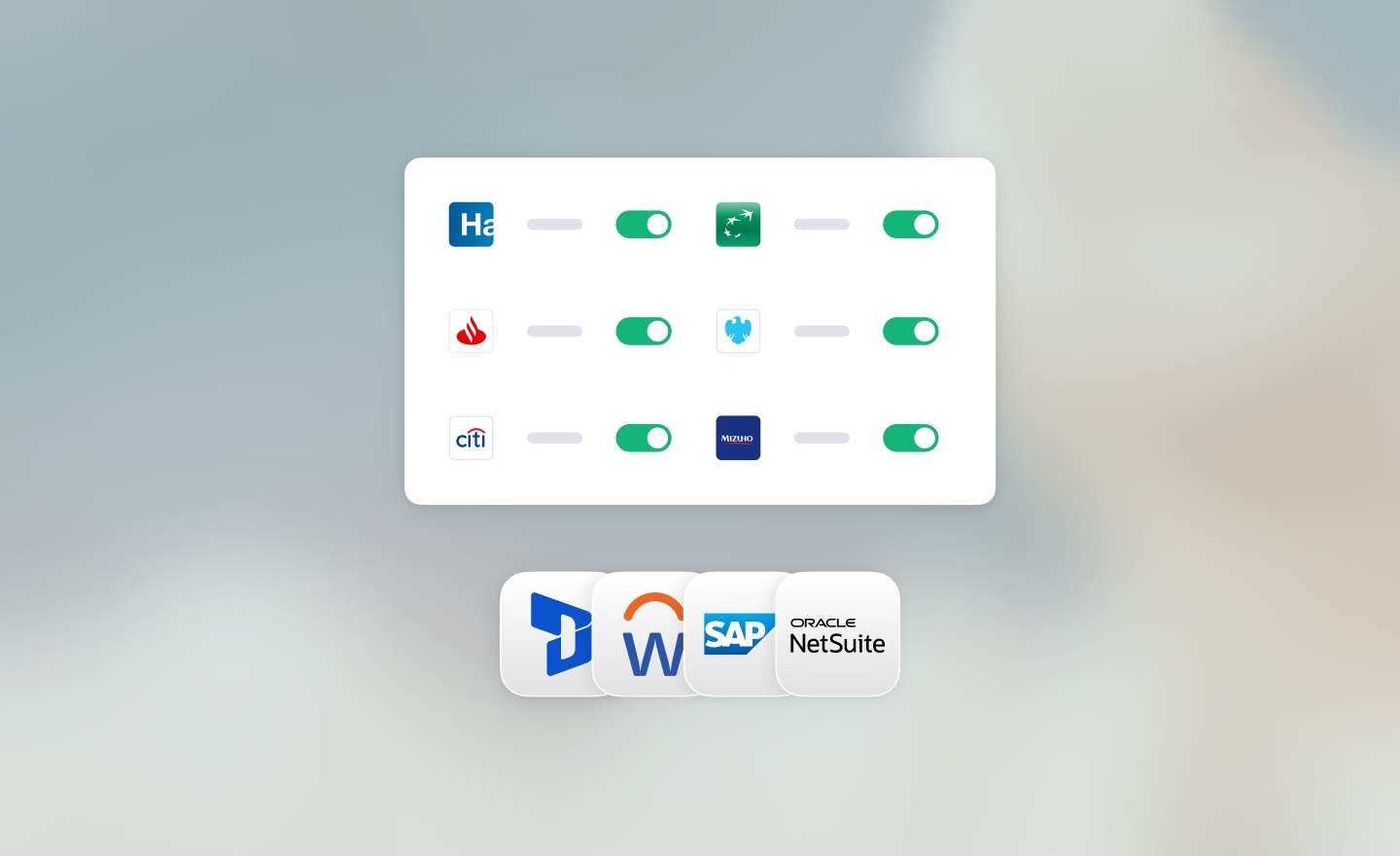

With Atlar you can access local IBANs, gain access to local payment rails, and comply with banking partner requirements from your underwriters through a unified API.

To save companies from manually managing payments and wasting engineering hours on non-core solutions, we have built a platform that allows you to support multiple currencies and local payment schemes from day zero.

Our platform supports audit trails so that you maintain granular oversight of each payment from initiation to reconciliation and approval chains to ensure that you can follow internal processes, like the four-eyes principle.

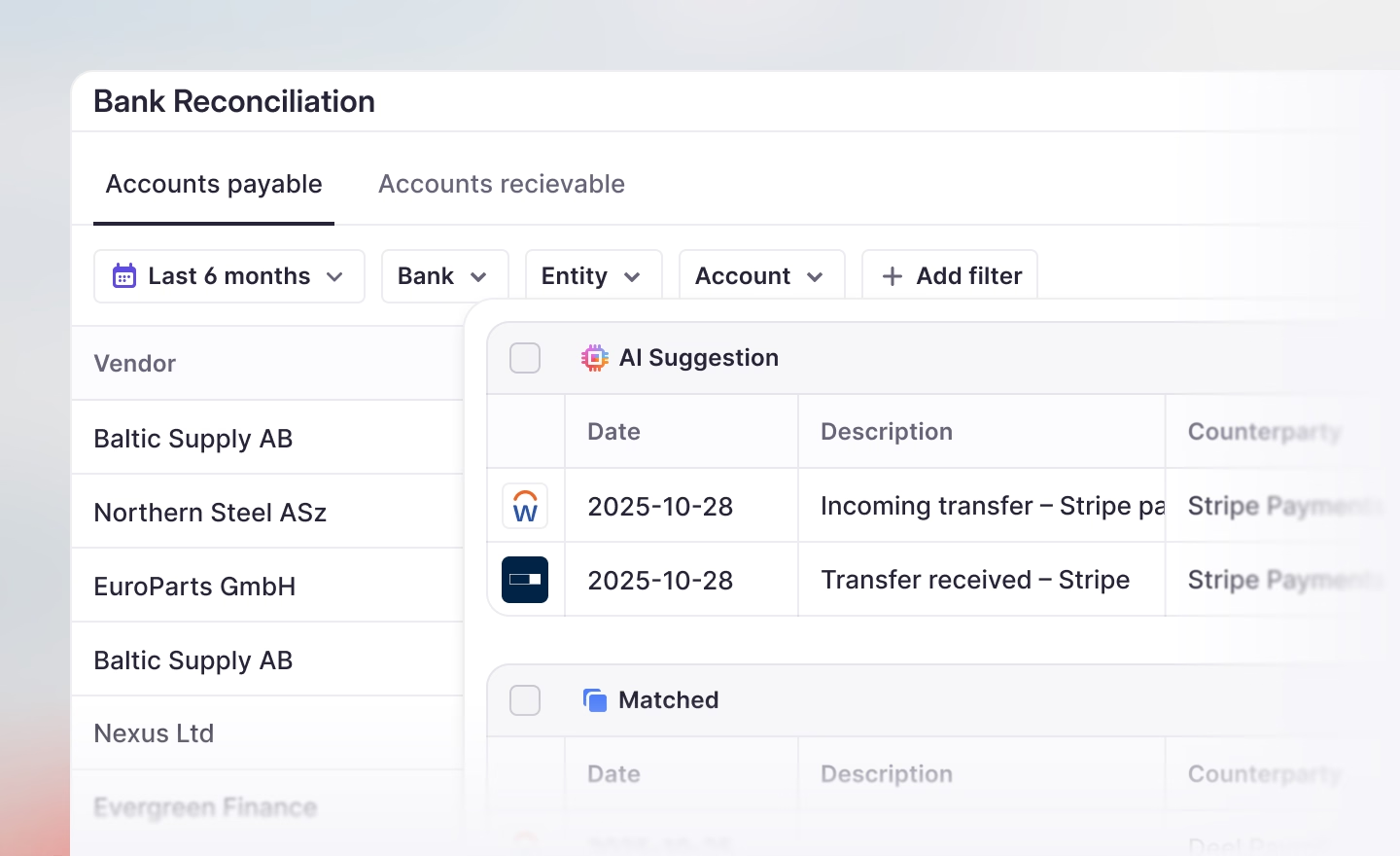

When you plug into Atlar’s API or use our dashboard, your company can manage payment flows end-to-end across all your banking partners – initiate credit transfers and direct debits, reconcile incoming payments, monitor balances across bank accounts, and track the status of payments live via webhooks to combat returns & refunds.

Get in touch

If payments are a core part of your business and you're either looking to expand across Europe or already serve customers in multiple European markets, get in touch. We would love to hear from you!

You can unsubscribe anytime.