Net and gross settlement

Net and gross settlement describe the two primary ways payment systems process and settle transactions between financial institutions.

Settlement systems: gross versus net

Settlement is the final, irrevocable transfer of funds between banks. The chosen method directly impacts a payment's speed, liquidity, and risk.

Real-time gross settlement (RTGS)

Each transaction is settled individually in real time. The instruction triggers an immediate, final transfer of funds between the banks' accounts. This provides maximum speed and certainty, eliminating settlement risk. The trade-off is that it requires participants to maintain higher liquidity buffers, as each payment must be funded individually.

Net settlement

Transactions are queued, offset against one another, and only the net amount owed is settled at a defined cycle end. This provides efficiency and liquidity savings, allowing high volume with less cash. However, it introduces settlement risk, as pending transactions could be affected if a participant fails before the final transfer.

Both methods are essential: RTGS networks (like Fedwire or TARGET2) enable high-value, time-critical payments, while net settlement systems (like ACH) efficiently process large volumes of low-value transactions.

Corporate risk and control implications

For treasury teams, the settlement method dictates distinct risk profiles:

- Liquidity Risk in Gross Settlement: Since funds are debited immediately, a company risks exceeding its intraday credit limits or causing an overdraft if it miscalculates the timing of an incoming fund or the exact balance needed to cover the immediate debit.

- Settlement Risk in Net Settlement: While systemic risk is borne by the bank, the corporate user faces operational risk from delayed or failed payment confirmation until the batch finalizes, complicating same-day cash positioning.

Knowing the settlement method is a crucial control point for accurately managing timing and cash balances.

The shift to hybrid and faster payments

Most countries operate both types of systems, with high-value transfers using RTGS and retail payments using deferred net settlement. However, payment infrastructure is evolving rapidly:

- Hybrid Models: Some modern systems now use real-time clearing (immediate message confirmation) combined with multilateral netting (periodic fund transfer) to achieve the speed of gross settlement while limiting the intraday liquidity demands.

- Instant Payment Schemes: The rise of systems like FedNow or similar instant schemes are fundamentally RTGS in nature. Their instantaneous, irrevocable settlement is changing the demand for traditional deferred net settlement and requiring treasurers to manage the co-existence of both slow batch cycles and instant gross payments.

Implications for treasury and liquidity management

Understanding settlement type is crucial for liquidity management. Gross settlement debits funds immediately, impacting available balances in real time. Net settlement delays outflows, which can temporarily improve apparent liquidity but demands careful monitoring to avoid shortfalls.

Treasury teams incorporate settlement timing into their cash positioning and forecasting models, ensuring accounts are sufficiently funded ahead of settlement windows. They coordinate payment timing to minimize intraday liquidity usage while meeting obligations.

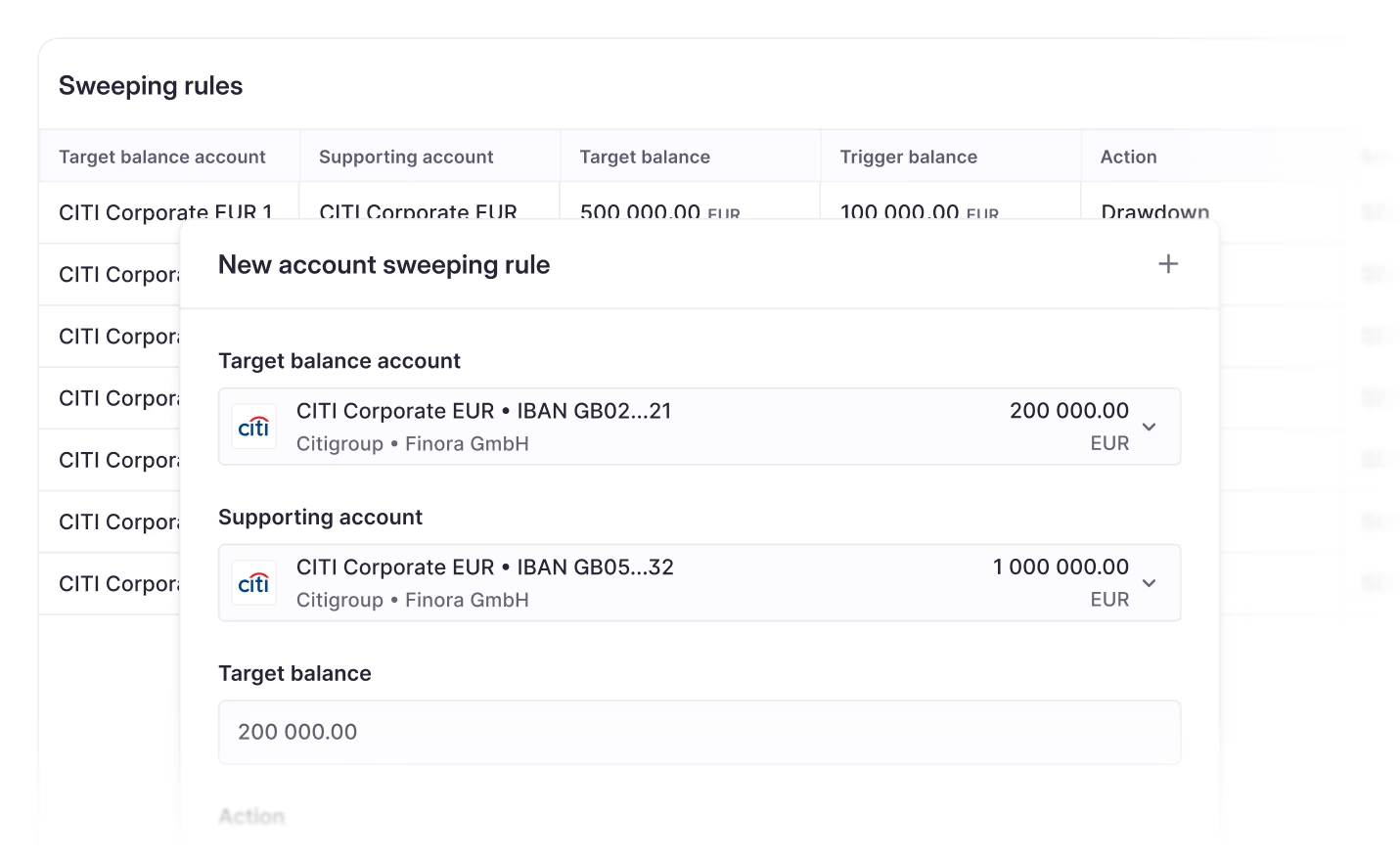

How Atlar can help with settlement visibility

Atlar provides real-time visibility into all payments, whether they settle individually or in batches. By connecting directly to banks and payment networks, Atlar updates transaction statuses as soon as settlement occurs, ensuring finance teams always know when cash has left or arrived.

With accurate timing data and centralized liquidity views, Atlar helps treasury teams plan for settlement cycles, manage funding needs, and maintain precise control over daily cash positions. Learn more on our payment operations page, or get in touch for the latest information on our capabilities.

You can unsubscribe anytime.

Further reading

See Atlar in action.

Enter your work email to watch a live product demo.