A Guide to Bank Payments in Denmark

Denmark is a payments frontrunner, launching one of the first instant payment systems in 2014. Today, more real-time payments are made per capita in Denmark than anywhere else in Europe while more established payment methods like direct debits remain popular.

Key facts

- Currency: Danish krone (kr)

- ISO currency code: DKK

- ISO country code: DK

- IBAN example: DK50 0040 0440 1162 43

- Key local schemes: A2A payments, MobilePay, Betalingsservice, Leverandørservice

- Settlement agent: Danmarks Nationalbank

Payment infrastructure

Similar to other Nordic countries, Denmark has been quietly innovating both its bank infrastructure and payment methods for years. The result is a strong ecosystem of local schemes and several options for moving money, both push- and pull-based.

Danes have been making use of instant account-to-account transfers since the launch of Express Clearing (‘Straksclearing’) in 2014. Today, the mobile payment app MobilePay is used by almost everyone for instant peer-to-peer transfers. Traditional payment types such as direct debits are still widely used, however. Having been around for several decades, the direct debit schemes 'Betalingsservice' and 'Leverandørservice' are used by consumers and businesses respectively.

All retail bank payments in Denmark are settled in the Kronos2 system, owned by the country's central bank, Danmarks Nationalbank, and cleared in one of three systems: Sum Clearing (‘Sumclearing’), Intraday Clearing (‘Intradagclearing’), and Express Clearing (‘Straksclearing’). These three systems dictate the settlement capabilities of the main schemes and payment methods available in Denmark.

In order to use one of Denmark’s domestic schemes, payments must be sent in DKK between bank accounts domiciled in Denmark. To move money locally businesses will need to open a DKK account with a bank that operates a Danish branch. You can get in touch with us here for recommendations regarding local banking partners.

Push-based payments

The main push-based payment types available in Denmark for retail use cases are account-to-account payments, including online bank transfers, and MobilePay. The launch of Express Clearing in 2014 made it possible to execute credit transfers in real time either as an instant account-to-account payment or via other services like MobilePay.

Two older push-based payment types are FIK/GIK and NemKonto payments. FIK/GIK payments are an OCR-based payment type used mainly for business invoicing. NemKonto is predominantly used for payments made by Danish public institutions, such as tax credits or state benefits, but businesses can use it to send money too.

Pull-based payments

Pull-based payments in Denmark are facilitated through the Betalingsservice and Leverandørservice direct debit schemes, both of which rely on the Sum Clearing settlement system.

Betalingsservice is used for direct debit collections between businesses and consumers while Leverandørservice is used for business-to-business transactions such as regular supplier payments.

Bank account numbers in Denmark

- BBAN format: AAAA YYYY YYYY YY

- IBAN format: DKDD AAAA YYYY YYYY YY

- Country code: DK

- Check digits (D): 50

- Bank code example (A): 0040

- Account number example (Y): 0440 1162 43

- BBAN example: 0040 0440 1162 43

- IBAN example: DK50 0040 0440 1162 43

In Denmark, the Basic Bank Account Number (BBAN) – which forms the domestic part of the IBAN – are fourteen digits long and formatted as AAAA YYYY YYYY YY. The first four digits denote the bank code or registration number (A) and the remaining ten digits denote the account number (Y). If the bank code or account number is shorter than the prescribed length, the BBAN is padded with leading zeroes to ensure it remains fourteen digits long.

Danish IBANs include the BBAN supplemented with a four-character header. This header includes 'DK', which stands for the two-letter national bank code from ISO 3166 for Denmark, along with two check digits (D).

Clearing and settlement

All retail payments in Denmark, whether credit transfers or direct debits, are processed through one of three clearing systems: Sum Clearing, Intraday Clearing, or Express Clearing. These systems enable next-day, same-day, and instant settlement respectively. Settlement and the final transfer of money is executed through the real-time gross settlement (RTGS) system for Danish kroner, Kronos2.

Today, these three systems are owned by Finance Denmark, operated by Mastercard Payment Services, and ultimately overseen by Danmarks Nationalbank.

Parts of this infrastructure are set to be replaced in the coming years as part of the TARGET DKK project. High-value and instant payments in Danish kroner will be migrated to the European Central Bank's T2 payment system and the TARGET Instant Payment Settlement (TIPS) system respectively. The launch is planned in April 2025 and will make Danish kroner the third currency that can be settled in the TIPS service after the euro and Swedish kronor.

You can find more information about this migration on the Danmarks Nationalbank website.

Payment methods

Account-to-account payments

When an individual or business in Denmark makes an account-to-account (A2A) payment, such as an online bank transfer, they can typically choose a desired transfer speed based on the clearing system used: Express Clearing, Intraday Clearing, or Sum Clearing. A2A payments have surged in popularity in Denmark thanks to the introduction of instant transfers in 2014 and the country is a global leader in terms of A2A payment adoption and volume.

Express Clearing: instant transfers

Express Clearing (Straksclearing) enables credit transfers to be executed between Danish bank accounts as an instant account-to-account (A2A) payment.

Individuals and businesses can make an instant transfer from their online banking interface and increasingly in other services too, thanks to the rise of open banking and mobile wallets like MobilePay, which uses Express Clearing for settlement.

Instant transfers were introduced to Denmark with the launch of Express Clearing (‘Straksclearing’) in 2014, a full three years before the SEPA scheme SCT Inst emerged in 2017, and their usage has increased rapidly in recent years. Four years after its launch, in 2018, the average Dane made around 60 instant transfers per year compared to 10 per capita in Sweden and the UK.

Today, instant transfers make up two-thirds of all person-to-person (P2P) transactions in Denmark, according to this report by Danmarks Nationalbank. In fact, the number of instant transfers has more than quadrupled since 2016, surpassing the adoption of equivalent systems like Faster Payments in the UK.

Express Clearing is an immediate credit transfer system available 24/7, 365 days a year. Clearing and settlement relies on the banks prefunding each transfer by providing liquidity to the central bank ahead of time. There is a maximum limit for instant transfers of 500,000 DKK for both individuals and companies.

Intraday Clearing: same-day transfers

Intraday Clearing (Intradagclearing) enables same-day bank transfers with payments settled four times a day at 01:30, 09:00, 12:00, and 14:00. It typically takes a few hours for the amounts settled to be available in the payee’s bank account. Transfers made via Intraday Clearing are made from one account to another and include online banking transfers, salary payments, and disbursements from the public sector.

Intraday Clearing is a net settlement system – meaning the banks settle the difference between payments to and from their customers at fixed times of the day – and is used today for standard credit transfers, including online bank transfers, salaries, and public sector payments. Prior to its introduction in 2013, all credit transfers in Denmark took at least one business day to settle.

Sum Clearing: next-day or standard transfers

Sum Clearing (Sumclearing) enables next-day bank transfers, traditionally known as standard credit transfers, with payments settled overnight at 01:30. Several payment methods in Denmark are settled in Sum Clearing, including the direct debit schemes Betalingsservice and Leverandørservice and FIK/GIK payments. It’s also used for debit card payments and ATM withdrawals.

MobilePay

- Year introduced: 2013

- Operated by: Vipps MobilePay

- Maximum amount: kr. 10,000 per transfer, kr. 15,000 per in-store payment

- Availability: 24/7, 365 days a year

- Settlement: Real time

- Clearing: Express Clearing

- Fee per payment: kr. 9.00 (approx.)

MobilePay is a mobile payment app launched in 2013 by Danske Bank that today is by far the most popular digital wallet in Denmark. It’s used by 92% of the population and remains free for consumers to use.

MobilePay merged with the Norwegian mobile wallet Vipps in 2022 to form Vipps MobilePay with ownership shared between a consortium of Norwegian banks and Danske Bank.

To use MobilePay in Denmark you must be at least 13 years old, reside in Denmark, have a Danish phone number and bank account, and have a CPR number. Transferring money to someone else with MobilePay requires only their mobile phone number and payments are processed in real time.

MobilePay is used most commonly by individuals to send and receive money. Other use cases include subscriptions, invoices, and paying online or in-store.

Pros and cons

- Pros: MobilePay offers real-time settlement, available 24/7. It's relatively easy to administer, plus remittance and reconciliation can be automated.

- Cons: MobilePay transaction amount limits are relatively low, and there's an additional fee charged on top of clearing and bank fees.

FIK/GIK payments

- Year introduced: Pre-2000

- Operated by: Mastercard Payment Services, Danske Bank

- Maximum amount: No upper limit per payment

- Availability: Monday to Friday

- Settlement: One business day

- Clearing: Sum Clearing

- Fee per payment: kr. 1.00-1.50

Also called OCR payments, FIK/GIK payments are a paper-based invoice format with a unique payment reference. They enable direct transfers from local banks and are used for supplier invoices in Danish kroner.

A creditor number identifies the recipient. The creditor number is connected to an underlying account number and remains the same even if the account is moved to another bank.

The FIK/GIK code is typically displayed at the bottom of a vendor's invoice. It's a unique string that identifies both the vendor and the invoice in relation to the payment. This code is the only information required in order to make such a payment. An example of a FIK code is +71<000000000000000+00000000< where 71+ denotes the payment type, followed by the creditor identifier and invoice number.

The FIK system is operated by Mastercard Payment Services and there are three types of FIK payment forms with different reference string formats:

- 71 (15-digit OCR)

- 73 (no OCR, free text)

- 75 (16-digit OCR, free text optional)

The GIK Giro system is part of Danske Bank and uses the form types below:

- 01 (no OCR, free text)

- 04 and 15 (both 16-digit OCR numbers)

FIK/GIK payments must be submitted by 18.30 to be credited to the beneficiary’s bank account on the following business day.

Pros and cons

- Pros: FIK/GIK payments are a low-cost option relative to credit transfers. Next-day settlement is guaranteed if the payment is sent before 18.30.

- Cons: It requires some manual work to pay through a FIK payment form, making it more susceptible to human error. FIK/GIK transactions may also need to be reconciled manually.

NemKonto payments

- Year introduced: 2003

- Operated by: KMD, on behalf of Digitaliseringsstyrelsen

- Maximum amount: No upper limit per payment

- Availability: Monday to Friday

- Settlement: Same day or one business day

- Clearing: Intraday Clearing or Sum Clearing

- Fee per payment: kr. 1.00-1.50

NemKonto, meaning ‘easy account’ in English, is a system used mainly for transactions between the public sector and citizens or businesses in Denmark. The Danish authorities use NemKonto payments to make tax or VAT refunds, disburse state benefits, and so on.

A NemKonto is a regular bank account that an individual or a business in Denmark designates as their primary account for receiving payments from the state or other registered senders. Every individual and business resident or domiciled in Denmark must have an assigned NemKonto.

The benefit of NemKonto is that it allows participants to use identifiers like civil registration number (CPR) or business registration number (CVR) to process payments instead of having to store bank account information for individuals or businesses in Denmark.

Private businesses have been able to send payments to a NemKonto account since 2008, enabling businesses to pay out money without maintaining payee account information – as long as they submit a valid identifier with the payment. Insurance and pension companies tend to use NemKonto for this purpose. Businesses are limited to sending a maximum of 80 files containing 10,000 payment messages per hour through NemKonto.

NemKonto payments are usually executed as next-day credit transfers using Sum Clearing but some banks also support same-day credit transfers. Note that actual settlement may be delayed since the identifier (CPR, CVR, etc.) is first validated before the payment can be processed.

Pros and cons

- Pros: NemKonto is a relatively low-cost option that does not require knowledge of an individual’s or company’s account number.

- Cons: The payee must be notified and have given consent to their data being used in advance of receiving a NemKonto payment. There is a large one-time fee required to connect to the service and an upper limit of 10,000 payment messages per hour.

Betalingsservice

- Year introduced: 1974

- Operated by: Mastercard Payment Services

- Maximum amount: No upper limit per payment

- Availability: Monday to Friday

- Settlement: One business day

- Clearing: Sum Clearing

- Fee per payment: kr. 2.50-5.00

Betalingsservice is the main direct debit scheme in Denmark used by consumers with more than 95% of Danes using it annually to make recurring payments for things like utility bills, subscriptions, and instalments.

In addition to the transaction cost, which ranges from 2.50 to 5.00 DKK depending on the bill size, businesses must pay a subscription fee of 149 DKK per month to collect direct debit payments through Betalingsservice.

Prior to collecting direct debits, a Betalingsservice mandate (or a ‘betalingsaftale’) must be signed by the customer that includes the full details of the direct debit. Customers can cancel their mandate at any time by contacting the bank. After three days from the cancellation request, no further payments can be collected from the customer’s account. The mandate will automatically expire if no collections have been made for 15 months.

Customers can request a refund no later than on the 7th day of the month when the collection was debited from their account. If a rejection or reversal is initiated after the payment has been made, the funds will be automatically debited from the merchant's account and returned to the customer. However, if the collection has not yet been made, it will be cancelled, and no funds will move between accounts.

Processing cycle

The cut-off for submitting Betalingsservice collections is 09.00 CET, six business days before the first day of the month in which the collection is scheduled. Collections can be made up to three business days before the first day of the next month if a ‘late’ fee is paid.

For example, to collect a payment in May you would need to submit it no later than six business days before the end of April. This makes Betalingsservice impractical for ad-hoc collections.

Pros and cons

- Pros: Betalingsservice is a low-cost way of collecting direct debits at scale with a long-lasting recurring payment mandate.

- Cons: The Betalingsservice cut-off times make it unsuited for ad-hoc collections and the payer must sign a mandate in advance.

Leverandørservice

- Year introduced: 1974

- Operated by: Mastercard Payment Services

- Maximum amount: No upper limit per payment

- Availability: Monday to Friday

- Settlement: Up to two business days

- Clearing: Sum Clearing

- Fee per payment: kr. 3.00 (approx.)

Similar to Betalingsservice, Leverandørservice enables the automatic collection of recurring payments between Danish bank accounts except it’s used exclusively for business-to-business (B2B) direct debit collections.

To enter into a Leverandørservice creditor agreement, the creditor must have an active Danish CVR number or tax registration number. Prior to collecting any direct debits, the debtor must give authorization in the form of a mandate.

The debtor can refuse a payment by sending a request in writing for the non-execution of the payment to the debtor’s bank. This applies only to the specific payment without disabling the mandate.

A refund can be requested for a payment already executed with a written request. The creditor cannot contest this refund request.

Processing cycle

The cut-off for Leverandørservice collections is 16.30, one business day before the desired execution date. When a payment is made before the cut-off, funds are made available to the creditor the following business day.

Pros and cons

- Pros: Leverandørservice is a low-cost way of collecting recurring payments from businesses and is easier to manage and reconcile than many other B2B payment types.

- Cons: Leverandørservice is not suitable for immediate or same-day payments and it requires a mandate to be created and signed in advance. Importantly, refund requests cannot be contested.

Looking ahead: instant payments on the rise

Denmark prides itself on its well-adopted real-time settlement infrastructure and instant account-to-account transfers are increasingly the norm for Danish consumers and businesses. The shift away from batch-based payments is set to accelerate, even without P27, with implications for any business or platform that still relies on manual workflows and legacy infrastructure.

Real-time, continuous settlement requires a greater level of automation for both initiation and reconciliation plus live tracking and new workflows for automated retries and faster approvals. The Atlar platform is built to support real-time payments in Denmark and elsewhere in Europe out of the box. To learn how we can help shift your payment flows to real time, get in touch with us here.

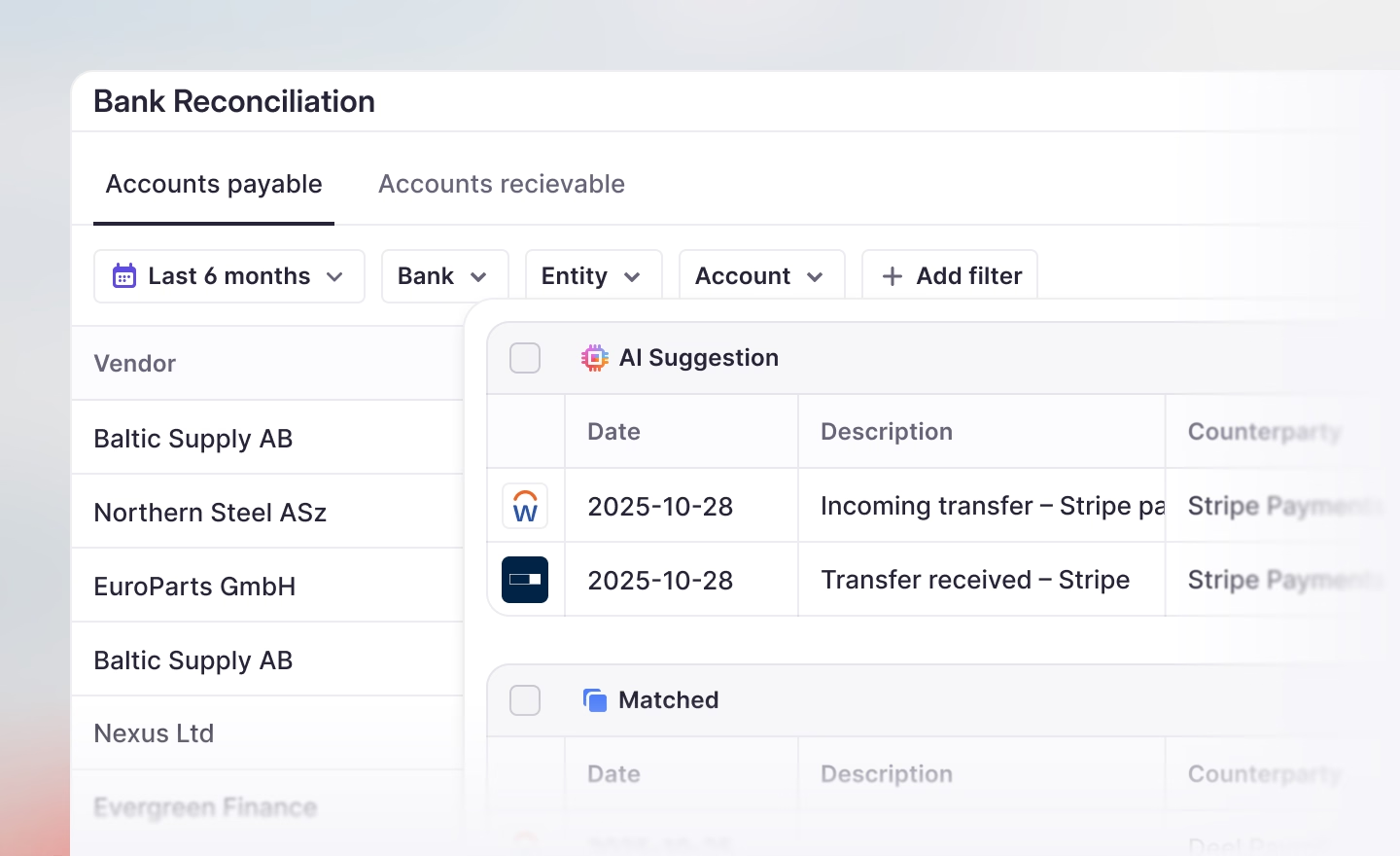

How Atlar can help

With Atlar, you can manage payments across all your Danish banks through a single API and unified dashboard. This enables automation of both incoming and outgoing flows—from initiation to reconciliation—saving hours typically spent on manual processing.

As Denmark’s payments landscape evolves, Atlar helps businesses avoid the complexity and cost of building and maintaining individual bank integrations. Real-time payment support is built in, so you can make the most of the country’s latest infrastructure developments with minimal effort.

Get in touch

If you're a company looking to access local schemes and automate payments in Denmark or elsewhere, we'd love to speak with you. Book a demo here.

You can unsubscribe anytime.

See Atlar in action.

Enter your work email to watch a live product demo.