A Guide to Bank Payments in Norway

Like its Nordic neighbours, Norway has a strong and diverse ecosystem for retail bank payments. Real-time payments, introduced in 2013, are now taking off commercially and adoption is growing faster than anywhere else in Europe.

Key facts

- Currency: Norwegian krone (kr)

- ISO currency code: NOK

- ISO country code: NO

- IBAN example: NO93 8601 1117 947

- Key local schemes: Account-to-account payments, Vipps, eFaktura, AvtaleGiro, Autogiro, KID payments

- Settlement agent: Norges Bank

Payment infrastructure

Norway's bank payment infrastructure is generally secure, enables fast payments, and provides multiple payment options suited to different use cases. Uptime is close to 100 percent across all of the main systems and, overall, the costs of sending and receiving payments are relatively low.

Norwegians have been able to make use of instant account-to-account (A2A) payments since the launch of the real-time clearing system 'Straks' in 2013, upgraded to Straks 2.0 in 2020. This is in addition to an intraday clearing system that enables same-day settlement on business days. A third clearing system is available for higher-value payments above 25 million NOK.

The central bank of Norway, Norges Bank, is currently seeking to upgrade to its real-time payment infrastructure. Although not part of P27 Nordic Payments from the outset, Norway was expected to join at some point. With P27 on hold, Norway is planning a new real-time system that will either be operated by Norges Bank itself or outsourced to the pan-European TARGET Services, as in Denmark and Sweden.

There are several options for credit transfers and direct debits in Norway such as instant A2A payments, online bank transfers, and the direct debit scheme AvtaleGiro. Invoice payments are also well-established in Norway and can be made using electronic invoices via online banking (eFaktura) or by submitting files with an OCR reference, like a 'Kunde ID' (KID).

In order to move money locally in Norway, payments must be sent in NOK between bank accounts domiciled in Norway. Businesses will need to open a NOK account with a bank that operates a Norwegian branch. Get in touch with us here for local banking partner recommendations.

Push-based payments

Account-to-account payments are today the most frequently used payment type in Norway. This includes standard credit transfers sent as an online bank transfer and instant payments using the real-time Straks scheme. Today the majority of instant payments are sent from the Vipps payment app as peer-to-peer (P2P) transfers.

Vipps is Norway’s most popular payment app with 4 million users in 2022, around three-quarters of the population. Since 2019 Vipps users have been able to pay eFaktura invoices in the app and it’s increasingly used for ecommerce and point-of-sale payments too.

eFaktura invoices let people receive and pay their bills directly in their online banking interface and are used widely in Norway. In 2022 there were 40 million eFaktura agreements in a country of 5.4 million people. Since eFaktura is not a payment service, the actual payment takes place as a credit transfer or direct debit payment.

KID payments are giro payments that use an optical character recognition (OCR) service based on a ‘Kunde ID’ (customer ID) or KID number. Businesses in Norway use KID numbers to pay suppliers and request payments from other businesses.

Pull-based payments

Pull-based payments in Norway are facilitated through the AvtaleGiro scheme, which is used for both B2C and B2B direct debit collections such as the paying of utility bills, phone subscriptions, and rent. eFaktura agreements can be combined with an AvtaleGiro agreement so that the invoice is paid automatically as a pull-based payment. Autogiro is another direct debit scheme available only for B2B collections and is used mainly for supplier payments.

Market data and trends

Zooming out briefly, it's worth noting that Norway has some of the highest rates of card use per capita in Europe. The average Norwegian owned three cards and made 531 card payments in 2022. The number of giro payments made per year is lower but the total value of giro payments is far higher, and rising fast.

In 2022 the average value of a giro payment was 26,046 NOK; for card payments it was 375 NOK. This reflects the fact that giro payments are used for large bills and salaries, but they have also become much more common for smaller, higher frequency payments. This trend has only accelerated since the launch of Straks 2.0 in 2020.

In 2022, instant payments (including Vipps transfers) overtook online banking transfers as the most popular type of giro payment in Norway. There were 259 million instant payments made in 2022, roughly 48 per person, up from 198 million payments in 2021. This increase can be partly explained by Vipps migrating P2P transfer volume moving over to Straks 2.0.

Direct debits, including the AvtaleGiro and Autogiro schemes, are the third most popular giro payment type in Norway though usage decreased slightly from 2021 to 2022. Postal giros and Telegiros are both becoming increasingly rare. Next to giro payments, eFaktura invoices continue to grow in usage despite their high penetration: the number of payments increased by 10% from 2021 to 2022 and there are over seven active eFaktura agreements per capita.

Bank account numbers in Norway

- BBAN format: AAAA YYYY YYY

- IBAN format: NODD AAAA YYYY YYY

- Country code: NO

- Check digits (D): 93

- Bank code example (A): 8601

- BBAN check digits (M): 0000000

- Account number example (Y): 1117 947

- BBAN example: 8601 1117 947

- IBAN example: NO93 8601 1117 947

In Norway, the domestic part of the IBAN – known as the Basic Bank Account Number (BBAN) – is eleven digits long and formatted as AAAA YYYY YYY. The first four digits represent the bank code (A) and the remaining seven digits represent the account number (Y).

Norwegian IBANs consist of the BBAN plus a four-character header. This header includes 'NO', which stands for the two-letter national bank code from ISO 3166 for Norway, along with two check digits (D).

Clearing and settlement

Norway’s central bank, Norges Bank, is the settlement agent for interbank payments in Norway and oversees the country’s payment systems. All payments made in NOK are settled in Norges Bank’s real-time gross settlement system, referred to as NBO.

The main clearing system is the Norwegian Interbank Clearing System (NICS), which is operated by Bits and regulated by Finance Norway. Transfers originating from some smaller, second-tier banks are first cleared through one of two privately owned clearing systems, DNB Bank and SpareBank 1 SMN, before they’re sent to NICS. There are two clearing systems for retail bank payments: NICS Real, which enables real-time settlement 24/7, 365 days a year, and NICS Netto, which provides same-day settlement on business days with a cut-off time around 14:30.

NICS Real, also known as Straks, was first introduced in 2013 as Norway’s real-time payment system and then upgraded to Straks 2.0 in 2020. Prior to Straks 2.0, the payee's account was credited before interbank settlement had been completed, leading to settlement risk for the payee’s bank. Today, real-time transactions are pre-funded with liquidity set aside at the central bank to guarantee settlement.

All retail payments are cleared through either NICS Net or Real. Interbank payments above 25 million NOK are settled in the separate NICS Gross system.

Payment methods

Account-to-account payments

When an individual or business in Norway makes an account-to-account (A2A) payment they can typically choose whether it’s sent as an instant or standard transfer, which in turn determines the clearing system used.

A2A payments in Norway can be made either as an online or mobile bank transfer or through the Vipps mobile payment app. Bank transfers are typically used to pay for things like bills or rent while the Vipps app is used for P2P transfers and increasingly other kinds of payments too.

Both NICS Real and NICS Net are managed by Bits, the group representing Norway’s banking sector, and operated technically by Mastercard Payment Services.

Instant transfers (Straks)

Straks 2.0 enables credit transfers to be executed between Norwegian bank accounts as an instant A2A payment. Individuals and businesses can make an instant transfer via online banking, the Vipps app, and increasingly in other services too thanks to the rise of open banking. Payments below 5,000 NOK are free for private individuals while payments above this limit cost 75 NOK per transaction.

Instant transfers were introduced with the launch of NICS Real, or Straks, in 2013 but the scheme wasn’t widely adopted by banks until Straks 2.0 was released in 2020. Norway has since seen a rapid increase in the number of instant transfers: 259 million were made in 2022, roughly 48 payments per person, with the majority initiated from the Vipps app.

Straks is an immediate credit transfer system available 24/7, 365 days a year. Final settlement is guaranteed by banks providing liquidity to the central bank ahead of time to pre-fund each transfer. There is a maximum limit of 40,000 NOK per transaction. New iterations of the Straks scheme are released on an ongoing basis in the form of Straks 2.1, 2.2., and so on.

Standard transfers

Standard or intraday transfers are typically made in an online or mobile banking interface and enable same-day credit transfers between Norwegian bank accounts. Invoice payments, salary payments, and public sector disbursements also tend to be sent as standard transfers.

NICS Net is a net settlement system, meaning the banks settle the difference between payments to and from their customers at fixed times of the day. Standard transfers are cleared on weekdays, five times a day: at 05:30, 09:30, 11:30, 13.30, and 15.30. Payments are sent to the NBO for final settlement shortly after each deadline. Typically the final bank cut-off time is around 14:30, after which payments are settled the next business day.

Payments over 25 million NOK are processed separately through NICS Gross or ‘Brutto’. This is a gross settlement system for higher-value transactions that are sent to the NBO for final settlement immediately.

Vipps

- Year introduced: 2015

- Operated by: Vipps MobilePay

- Maximum amount: 650,000 kr. per year

- Availability: 24/7, 365 days a year

- Settlement: Near-instant

- Clearing: NICS Real (Straks)

- Fee per payment: 1.75-2.99% + 1 kr.

Vipps is a Norwegian mobile payment app, similar to Venmo or Zelle, that’s used by about 75% of the adult population and lets people transfer money to friends and family and make online or in-store purchases online or in-store. Since 2019 users can also receive and pay eFaktura invoices in the Vipps app. The app functions by connecting the user’s mobile phone number to their bank account.

Individuals can use Vipps to pay through an email address, phone number, or by scanning a QR code. Businesses that register to use Vipps receive a unique 5-digit Vipps number through which they can also receive transactions. Vipps is increasingly popular among smaller merchants as it’s a simple way of accepting payments at the point of sale and safer than dealing with cash.

Vipps is operated by Vipps MobilePay, which itself is owned by Danske Bank and a consortium of Norwegian banks. It’s a member of the European Mobile Payment Systems Association along with Swish, iDEAL, BLIK, and other national mobile payment providers.

Individual recipients of Vipps transfers are never charged and transfers of less than 5,000 NOK are free. For transactions above this amount, the sender is charged a 1% fee. Vipps also enforces annual transaction limits. To use Vipps in Norway you must be at least 15 years old, have a Norwegian bank account and phone number, and have a Norwegian social security number.

Businesses that wish to accept Vipps payments must have a Norwegian registration number and bank account. Transaction fees vary based on annual volume but the higher pricing tiers are as follows:

- Vipps Checkout: 2.49% plus 1 NOK

- Online transactions: 2.99% plus 1 NOK

- Point-of-sale transactions: 1.75%

Pros and cons

- Pros: Vipps offers a fully digital, user-friendly experience with real-time settlement and is used by three-quarters of Norway's population.

- Cons: Vipps charges higher fees relative to other account-to-account payment methods.

eFaktura

- Year introduced: 2001

- Operated by: Mastercard Payment Services

- Availability: Monday to Friday

- Settlement: Same day

- Clearing: NICS Net

- Fee per payment: 3.50-8.00 kr.

eFaktura is a service provided by Norway’s banks that enables businesses to send electronic invoices to other businesses or private individuals via their online banking interface. It's the most popular way for Norwegians to pay their bills: over 40,000 businesses use it to send invoices and around 4 million Norwegians have at least one eFaktura agreement in place.

eFaktura itself is not a payment service and the actual payment of an e-invoice uses one of the payment services available in the receiving interface: a standard credit transfer via online banking, a Vipps payment, or a direct debit payment.

There are two eFaktura solutions, one for B2C and one for B2B payments. With eFaktura B2C, consumers can receive invoices from any invoice issuer regardless of who they bank with provided they have an agreement with the issuer. This agreement is tied to the customer's social security number. The customer has to confirm each payment but does not have to enter the account number, KID number, amount, and due date. Issuers can also combine eFaktura with AvtaleGiro so that bills are automatically deducted from the payer's account, provided they submit the relevant files to the AvtaleGiro system.

eFaktura B2B lets companies exchange invoices with customers and suppliers instead of handling paper-based invoices. Several Norwegian banks allow smaller companies to receive and pay invoices directly in their online banking interface. Larger businesses can receive e-invoices as files sent from the bank.

A payment request sent as an eFaktura invoice must contain the following information: organisation number, issuer's name, credit card number, amount, due date, e-invoice reference, the invoice URL, and payment type. A ‘Kunde ID’ or KID number is optional but recommended.

The cost is roughly 3.50 NOK per B2C invoice and 8.00 NOK per B2B invoice and there are also several fees associated with setting up, registering, and changing an invoice agreement.

Pros and cons

- Pros: eFaktura guarantees same-day settlement, provided the payment is sent before the cut-off time, and does not have a transaction amount limit.

- Cons: Businesses need to pay to use the eFaktura service on top of their transaction fees.

KID payments

- Year introduced: Pre-2000

- Operated by: Mastercard Payment Services

- Availability: Monday to Friday

- Settlement: Same day

- Clearing: NICS Net

- Fee per payment: 1.30-2.50 kr.

KID payments refer to a giro payment using an optical character recognition (OCR) service based on a ‘Kunde ID’ (customer ID) or KID number. The KID number is a unique reference that identifies the payer and provides information about the transaction which the receiving bank validates. Businesses use KID numbers to send and receive bank payments electronically based on a payment ID, similar to a FIK/GIK payment in Denmark.

KID numbers can be 4-25 digits long and it is essential that it is written correctly to ensure proper payment. KID numbers can be broken down into three of four basic components. An example is (1234567)(00)(12345)(3) where:

- 1234567 denotes the customer ID (required)

- 00 denotes the payment type (optional)

- 12345 denotes the invoice ID (required)

- 3 is the control digit (required)

The customer ID is unique to each payer and should be used consistently in all payments related to a specific customer or supplier. The payment type can be used to identify different items paid for by the same customer, such as different products or services. The invoice ID is unique to each payment or invoice, while the control digit is calculated separately and added to ensure the KID is processed correctly.

Using a KID number generally means businesses can access a lower bank fee per transaction than would otherwise be possible. eFaktura invoices use KID numbers but allow the payer to pay without entering it manually. KID payments are executed as standard credit transfers using NICS Net and are settled on the same business day if submitted before 14.30.

Pros and cons

- Pros: KID payments are low-cost compared to credit transfers and guarantee same-day settlement if sent before 14.30.

- Cons: It can require manual work to pay using a KID number and KID payments are therefore more susceptible to human error. The payments may also have to be reconciled manually.

AvtaleGiro

- Year introduced: 1995

- Operated by: Mastercard Payment Services

- Availability: Monday to Friday

- Settlement: Same day (on due date)

- Clearing: NICS Net

- Fee per payment: 4.00-8.00 kr.

AvtaleGiro is Norway’s direct debit scheme and enables automatic payments for both B2C and B2B use cases including utility bills, mobile phone plans, subscriptions, rent, loans, and more.

The payer's bank ensures that the account is debited on the due date. The payer can choose to be notified by the bank before the money is withdrawn from their account. Many consumers opt to use a combination of AvtaleGiro and eFaktura to pay their bills: they receive an eFaktura invoice in their online banking system while the amount is automatically debited from the account on the due date.

The fees for using AvtaleGiro vary by bank but can be around 10.00 NOK per B2B direct debit and 6.00 NOK per B2C direct debit. Banks also charge one-time fees to register, change, and delete AvtaleGiro agreements that range from 800.00 to 1,500.00 NOK.

Prior to using AvtaleGiro, businesses must first enter into a general agreement with a bank. Then an AvtaleGiro agreement or mandate must be signed by the payer before a business can start collecting payments. The mandate must include the KID number, the payer’s account number, the payee’s account number, the amount limit, and customer notification preference.

AvtaleGiro mandates can be changed or cancelled by the payer in their online banking interface or by contacting the bank directly. The payer can change the account from which payments are made, the amount limit, and their notification preferences.

Processing cycle

There are two AvtaleGiro processing cycles depending on how the payer is notified of the upcoming payment.

If the payee notifies the payer directly, or via an eFaktura invoice, the submission deadline is 14:00 (on business days only) four business days before the payment due date. The payer must be notified at least three calendar days before the due date or the payment may be reversed.

If the payer is notified via their own bank, an earlier deadline applies. Payments with a due date between the fifteenth day of a given month and the fourteenth day of the following month must be submitted before 14:00 on the last business day of the previous month.

For example, to collect a payment in the first two weeks of August or the last two weeks of July, you would need to submit a payment claim before 14.00 on the last business day of June. This processing cycle makes AvtaleGiro impractical for ad-hoc collections.

Pros and cons

- Pros: AvtaleGiro is a low-cost way of collecting direct debits at scale through a low-maintenance and long-lasting recurring payment mandate.

- Cons: AvtaleGiro requires a mandate to be created and signed in advance and is not suitable for immediate or ad-hoc payments.

Autogiro

- Year introduced: 1995

- Operated by: Mastercard Payment Services

- Availability: Monday to Friday

- Settlement: Same day

- Clearing: NICS Net

- Fee per payment: 6.00-10.00 kr.

Autogiro is a direct debit service that can be used exclusively for B2B payments. It was previously Norway’s main direct debit scheme until it was replaced by Avtalegiro for private individuals in 2000. Today it’s used by businesses that have a fixed set of business customers to collect payments on a regular basis, helping suppliers avoid the hassle of sending paper-based invoices.

Autogiro is based on an agreement in which the payer’s bank authorizes the transfer of an agreed amount to the payee on the due date. The payee is responsible for notifying the payer.

There are a few key differences between Autogiro and AvtaleGiro. With Autogiro’s intraday settlement cycle it’s possible for the payee to receive funds for an item on the day of purchase. Secondly, the payer cannot terminate an Autogiro agreement directly – only the payee or payer’s bank can terminate an agreement. Also, if an initial collection fails due to insufficient funds, the payee can retry a collection within three days.

There are two types of Autogiro agreements that payees can choose from:

- A standard agreement that states the maximum amount that the payee can charge the payer during a specific period.

- A simplified agreement that does not state a maximum amount or period. To use this authorization, the payee must notify the payer of the payment amount three business days before the payment is due.

The regulator of Autogiro, Bits, recently increased the amount of information the payee needs to provide on a payer in an agreement. It now requires the payer's organization number and address, plus the name and date of birth of the individual.

Processing cycle

Assuming there’s already an agreement in place, with Autogiro it’s possible for a payee to collect payment from a payer on the same day an item is purchased. There are four submission deadlines daily: 09:45, 10:45, 13:45, and 16:45. If data is submitted after 13:45 and before 16:45, the payment will be settled the next morning by 05:30.

Pros and cons

- Pros: Autogiro offers the ability to collect same-day direct debit payments and cannot be canceled by the payer at will.

- Cons: Banks typically charge higher fees for Autogiro compared to AvtaleGiro and the agreements require a higher level of information on the payer.

Looking ahead: new real-time systems

Norway's central bank, like its counterparts in Denmark and Sweden, is working on a next generation settlement system that’s fully equipped for real-time payments and can better support emerging use cases, like point-of-sale payments.

In late 2022, Norges Bank announced it had begun talks to join the pan-European TIPS system. This would mean Norway follows Denmark and Sweden in using the TIPS platform to settle real-time interbank payments in their local currencies. The alternative is that Norges Bank would expand its role as a payment system operator, creating and managing a new real-time system itself. An official decision will be made by the end of 2025.

In any case, Norges Bank expects real-time payments to continue increasing. The NICS Real (Straks) clearing system continues to evolve too with several new versions planned or already released – Straks 2.1, 2.2, and 2.3 – which will replace legacy national formats with ISO 20022 among other changes.

Real-time payments are increasingly the norm in Norway and adoption is growing faster than anywhere else in Europe. The shift away from batch-based payments is set to cause headaches and inefficiencies for businesses that rely on manual workflows and legacy infrastructure. Manually initiating and reconciling payments is more manageable with batch-based cycles and predictable inflows and outflows.

With real-time payments, settlement occurs continuously, 24 hours a day and 365 days a year. Automation is required to reap the full benefits of real-time settlement, letting you move money as efficiently as possible and unlock features like live tracking, automated retries, and faster approvals.

The Atlar platform is built to support real-time payments in Norway and elsewhere in Europe out of the box. Get in touch with us here if you’d like to learn more.

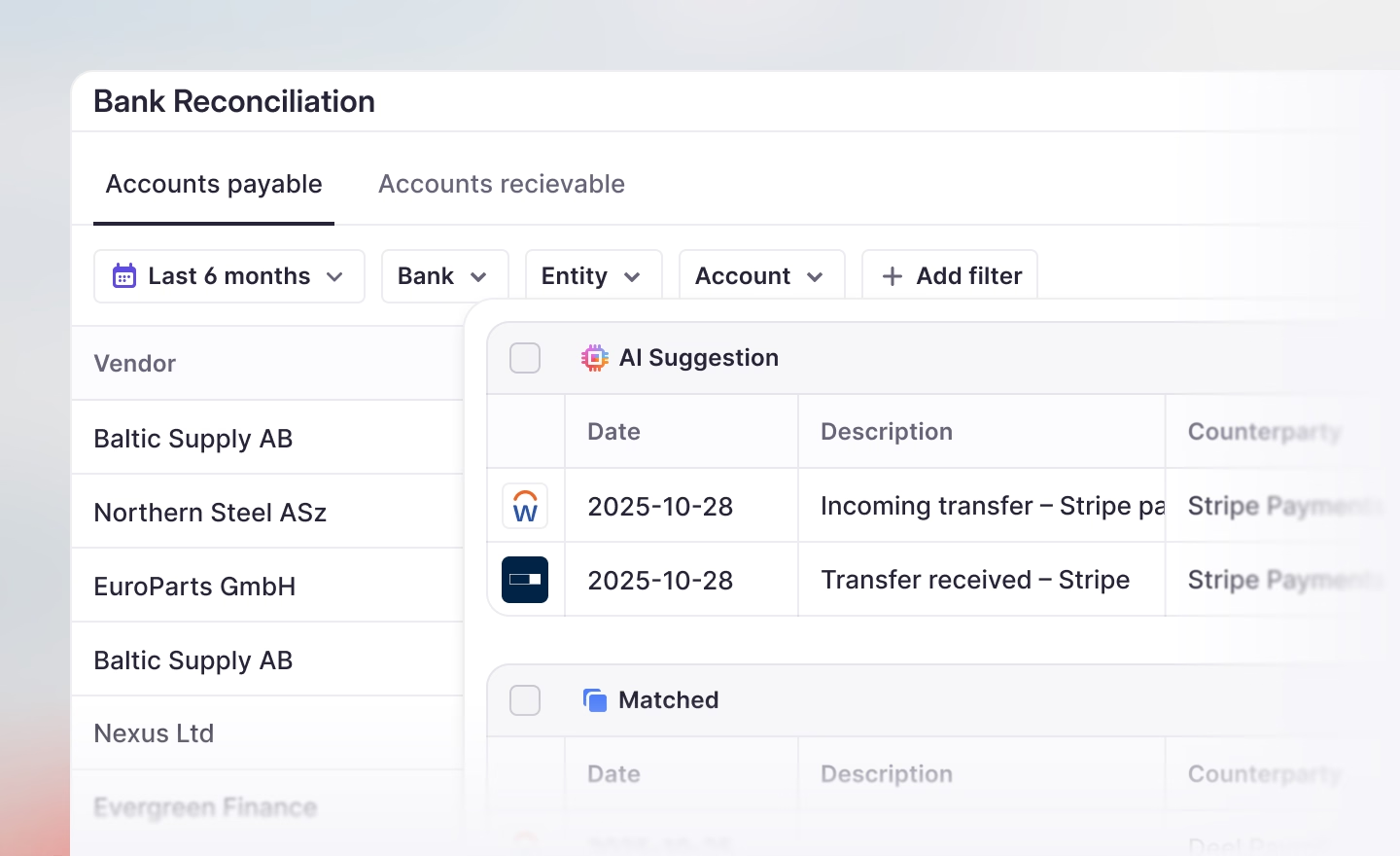

How Atlar can help

Atlar gives you access to local payment capabilities in Norway through a single API, letting you manage cash across all your banks—Norwegian or international—from one central dashboard.

This means payments are fully automated from initiation to reconciliation, no matter the rails used, saving countless hours otherwise spent on manual payment processing. Atlar is also designed with real-time payments in mind, so you can tap into the latest instant payment options in Norway and other markets effortlessly.

Norway’s payment systems are set to continue evolving with a new real-time scheme expected in the coming years. The Atlar platform makes adapting to infrastructure changes quick and painless, now and in the future.

Get in touch

If your business needs to automate payments using local schemes in Norway or more easily manage cash at Norwegian banks, we'd love to speak with you. Book a demo here.

You can unsubscribe anytime.

See Atlar in action.

Enter your work email to watch a live product demo.